![]()

11.21.2016 Today, CFPA released a report that examines the current uptake of the excess medical deduction among senior and/or disabled CalFresh participants. The report estimates the impact that a higher rate of uptake would have on a typical household’s average monthly benefit and on total benefits statewide.

Applying allowable deductions often results in a lower net income for a household, which increases the likely benefit amount. In general, for every three dollars less in net income, there is roughly a one dollar increase in benefits, up to the maximum benefit allowed per household. Put simply, maximizing the use of medical expense deductions can increase CalFresh benefits and put more food on the table for low-income seniors and people with disabilities.

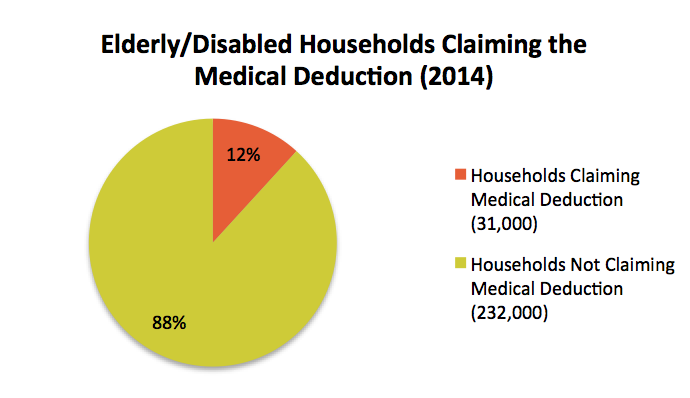

Unfortunately, the most recently available data (FFY 2014) show that only 12 percent of those eligible received the medical expense deduction (the vast majority of households with a senior or disabled member, more than 232,000 statewide, did not receive the medical expense deduction).

To increase CalFresh benefits and reduce food insecurity among low-income seniors and people with disabilities, state and county administrators should employ the following strategies to increase uptake of the medical deduction:

Access the full report, Seniors and the CalFresh Medical Expense Deduction. PDF

Read our two page summary of state strategies to increase CalFresh participation and benefits for seniors. PDF

Learn more about efforts to improve CalFresh at CFPA’s CalFresh page.

Questions? Contact Jared Call at 213.482.8200 ext. 201